The credit scoring system often raises concerns among first time buyers in Middlesbrough and home movers in Middlesbrough, who may perceive it as an unfair method employed by mortgage lenders to assess applications.

It’s essential to understand that mortgage lenders have their own perspective on this matter. Credit scoring enables them to minimise risk and ensure more consistent outcomes at a lower cost.

If you find yourself worrying about the credit scoring system’s impact on your mortgage application, there’s no need to panic. It’s important to remember that numerous mortgage lenders exist, each with their own unique scoring systems and criteria.

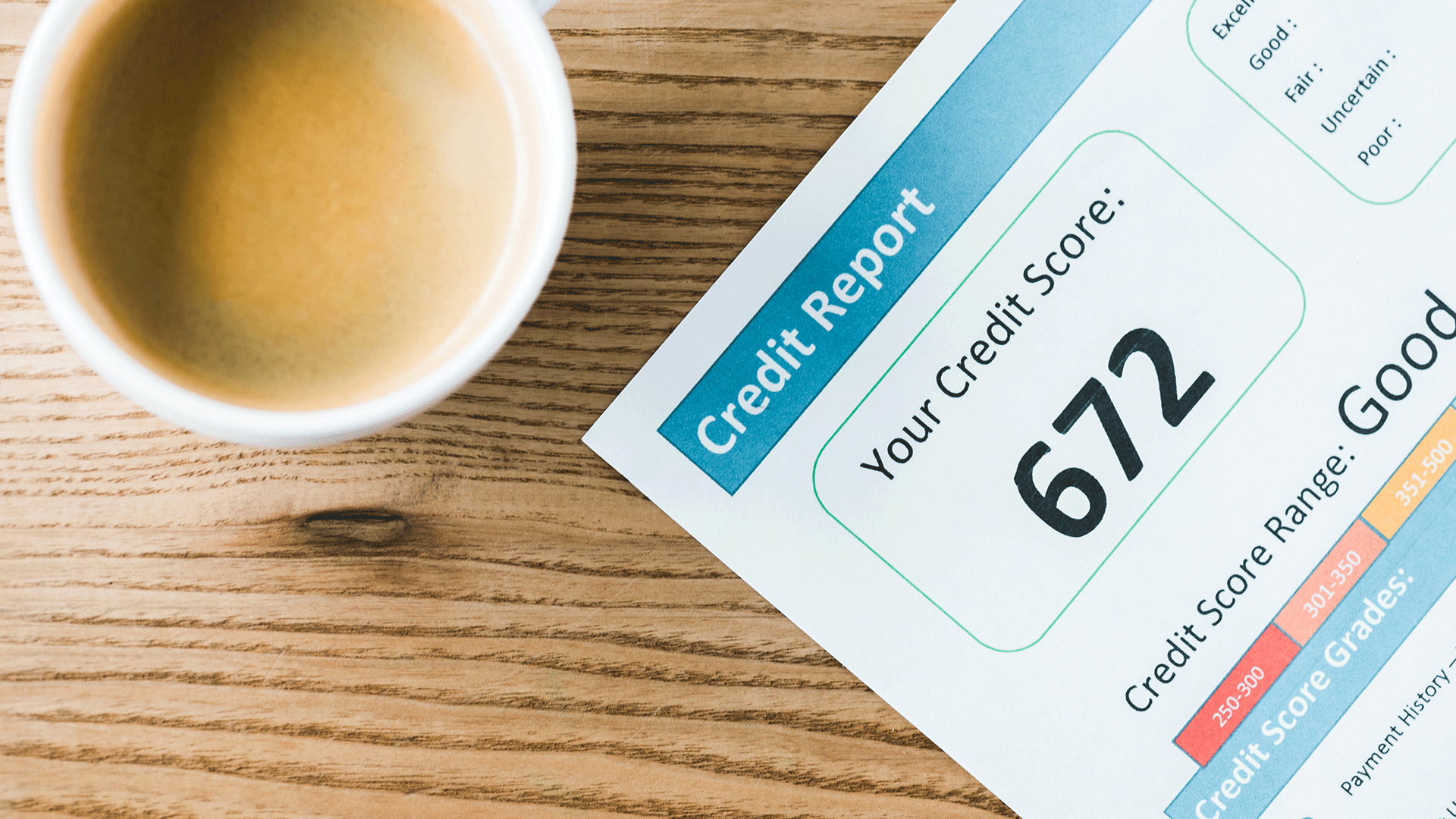

To navigate this process effectively, obtaining a copy of your credit report can prove highly beneficial when applying for a mortgage.

By providing an up-to-date copy of your credit report to your mortgage advisor in Middlesbrough at the outset, you significantly enhance your chances of being accepted on your first attempt.

This proactive approach allows your mortgage advisor in Middlesbrough to have a comprehensive understanding of your financial history and can help tailor their recommendations accordingly.

It’s worth noting that credit reports are not static and can be influenced by various factors. Therefore, taking the initiative to review and address any potential issues or discrepancies on your credit report in advance can greatly improve your overall mortgage application experience.

Rest assured that your mortgage advisor in Middlesbrough is well-versed in navigating the complexities of credit scoring systems and can guide you towards suitable lenders whose criteria align with your financial circumstances.

Their expertise and access to multiple lenders give you the best chance of finding a mortgage that meets your needs while minimising any potential hurdles that you could be faced with.

Obtaining a Copy of Your Credit Report

There are several credit reference agencies available, including well-known ones like Experian and Equifax. We recommend using CheckMyFile as it offers a comprehensive overview by combining information from multiple agencies.

CheckMyFile provides a convenient platform for obtaining your credit report, giving you a holistic view of your credit history and financial standing. It offers a 30-day free trial period, which can be cancelled at any time to ensure flexibility and convenience.

By using the link provided below, you can access a special offer to receive a free, instant PDF download of your credit report. This allows you to quickly and easily review your credit information and address any potential issues or discrepancies.

It’s a valuable resource that can empower you with the knowledge needed to make informed decisions when applying for a mortgage or engaging in any financial transactions.

Taking the time to review your credit report can greatly improve your chances of a successful mortgage application and help you understand the factors influencing your creditworthiness.

Try it FREE for 30 days, then £14.99 a month – cancel online anytime.

Tips to Improve Your Credit Score

When aiming to improve your credit score, it’s important to be mindful of certain factors that can have an impact. Here are some key considerations:

- Price comparison websites: Be cautious when using these platforms as they may generate credit searches that can potentially affect your score. It’s advisable to limit the number of searches you make to avoid any negative impact.

- Applying for additional credit: If you have plans to apply for a mortgage in the near future, it’s recommended to refrain from applying for additional credit during this time. Mortgage lenders generally prefer to see a stable borrowing pattern and may view recent credit applications as a risk factor.

- Electoral register: Being registered on the electoral register can boost your credit score. Ensure that your name and address are accurate and up to date, as this information is used to establish your creditworthiness.

- Credit card usage: It’s important to maintain responsible credit card usage. Avoid maxing out your credit card each month and aim to pay off the balance in full. This demonstrates financial discipline and can have a positive impact on your score.

- Closing unused accounts: While closing down store or credit card accounts that you no longer use may initially have a short-term negative effect on your score, it can be beneficial in the long run. It reduces the risk of fraudulent activity and streamlines your credit profile.

- Financial associations: If you have a financial connection to someone with a poor credit history, such as a joint account or shared financial responsibilities, their credit history could potentially impact your score. If the accounts are still active, it may not be possible to remove these associations. If the accounts have been closed, you can request that credit reference agencies remove the financial links.

Remember, providing comprehensive information to your trusted mortgage advisor in Middlesbrough is crucial. It allows them to offer tailored guidance and support that aligns with your specific needs.

By fostering open and transparent communication, you increase the likelihood of receiving optimal help throughout your mortgage process.

Date Last Edited: June 4, 2025